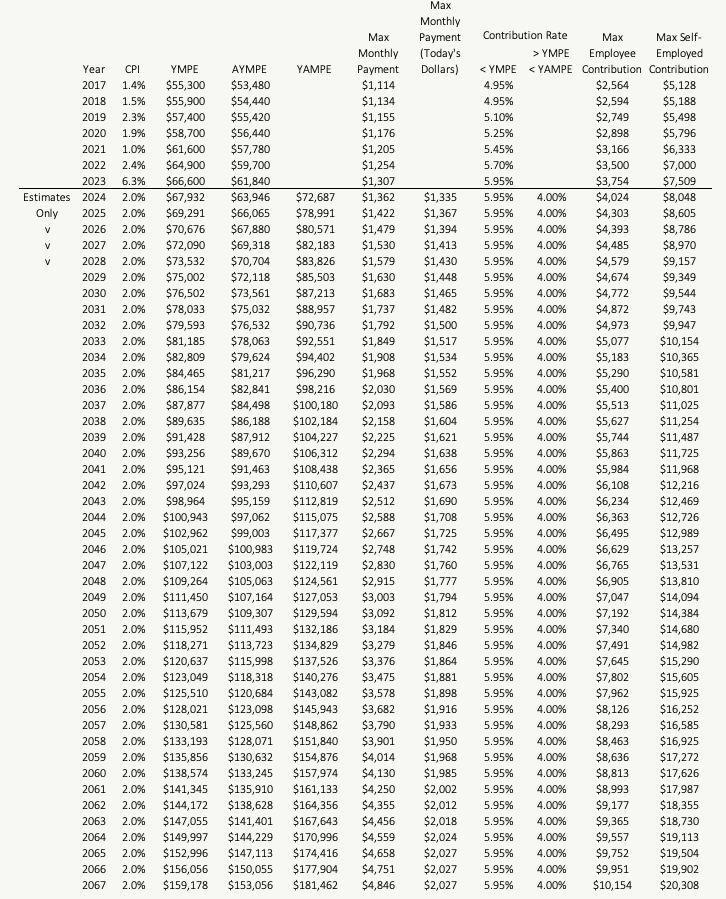

Cpp Limits 2025. Cpp payments are made monthly, and the. Starting on january 2025, employees who earn more than $68,500 are subject to an additional 4% “enhanced cpp” up to $73,200 in income (2025) and.

The 2025 maximum cpp contribution for employees is $3,754.45 ($6,100 x 5.95%). 2025 federal tax bracket thresholds.

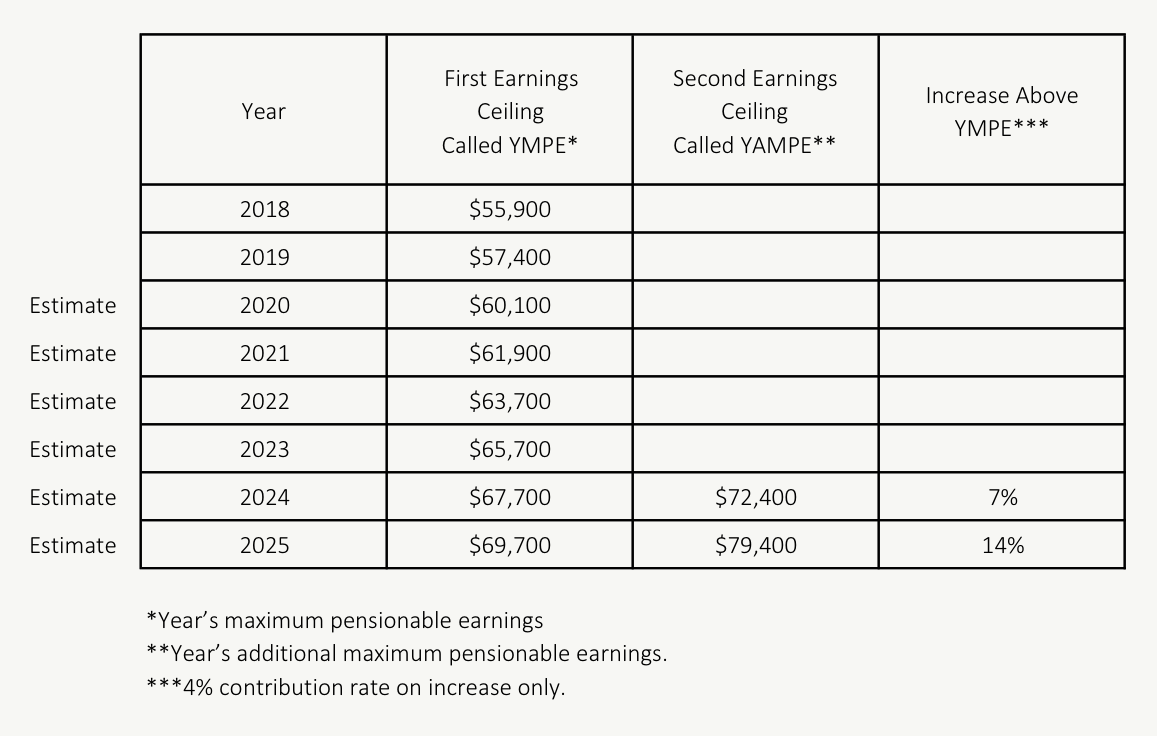

Canada Pension Plan Payment Dates How Much CPP Will You Get This Year, Cpp payments are made monthly, and the. The cpp now includes a new, second earnings ceiling.

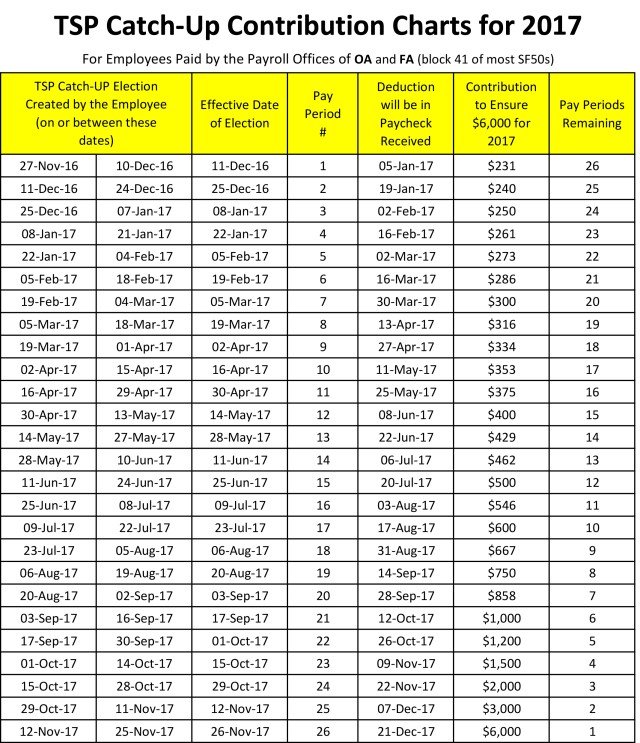

Thrift Savings contribution charts available Article The United, The maximums payable by employers and employees for 2025 is up 4.66% from 2025. Your bank or credit union is part of the zelle network:

Canada Pension Plan (CPP) Is Expanding! And That’s Going To Make, You will continue paying a 5.95% cpp contribution on the maximum pensionable earnings the cra determines. So, the average cpp benefit for someone starting the payment at age 70 will rise.

The CPP Max Will Be HUGE In The Future PlanEasy, How will the cpp enhancement plan affect. The 2025 maximum cpp contribution for employees is $3,754.45 ($6,100 x 5.95%).

Significant HSA Contribution Limit Increase for 2025, 2025 federal tax bracket thresholds. Beginning january 1, 2025, you must deduct the second additional cpp contributions (cpp2) on earnings above the annual maximum pensionable earnings using the.

New HSA/HDHP Limits for 2025 Miller Johnson, The basic personal amount before any personal tax applies has. Canada pension plan (cpp) and employment insurance (ei) cpp contributions for 2025.

2025 Tax Changes in Canada RRSP, TFSA, EI, CPP Limits and More, You will continue paying a 5.95% cpp contribution on the maximum pensionable earnings the cra determines. Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each—up from $3,754.45 in 2025.

2025 Hsa Catch Up Contribution Limits Tana Zorine, The maximum limit of earnings protected by the cpp will also increase by 14% between 2025 and 2025. Here are the changes to cpp deductions starting in 2025.

Acp Limits For 2025 Addie Anstice, Starting on january 2025, employees who earn more than $68,500 are subject to an additional 4% “enhanced cpp” up to $73,200 in income (2025) and. Employee and employer cpp2 contribution rate:

2025 Contribution Limits Announced by the IRS, The maximum limit of earnings protected by the cpp will also increase by 14% between 2025 and 2025. Cpp maximum pensionable earnings for 2025.

Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each—up from $3,754.45 in 2025.