Tax Brackets 2025 South Africa Companies. Rates of tax for individuals. On this page, you will.

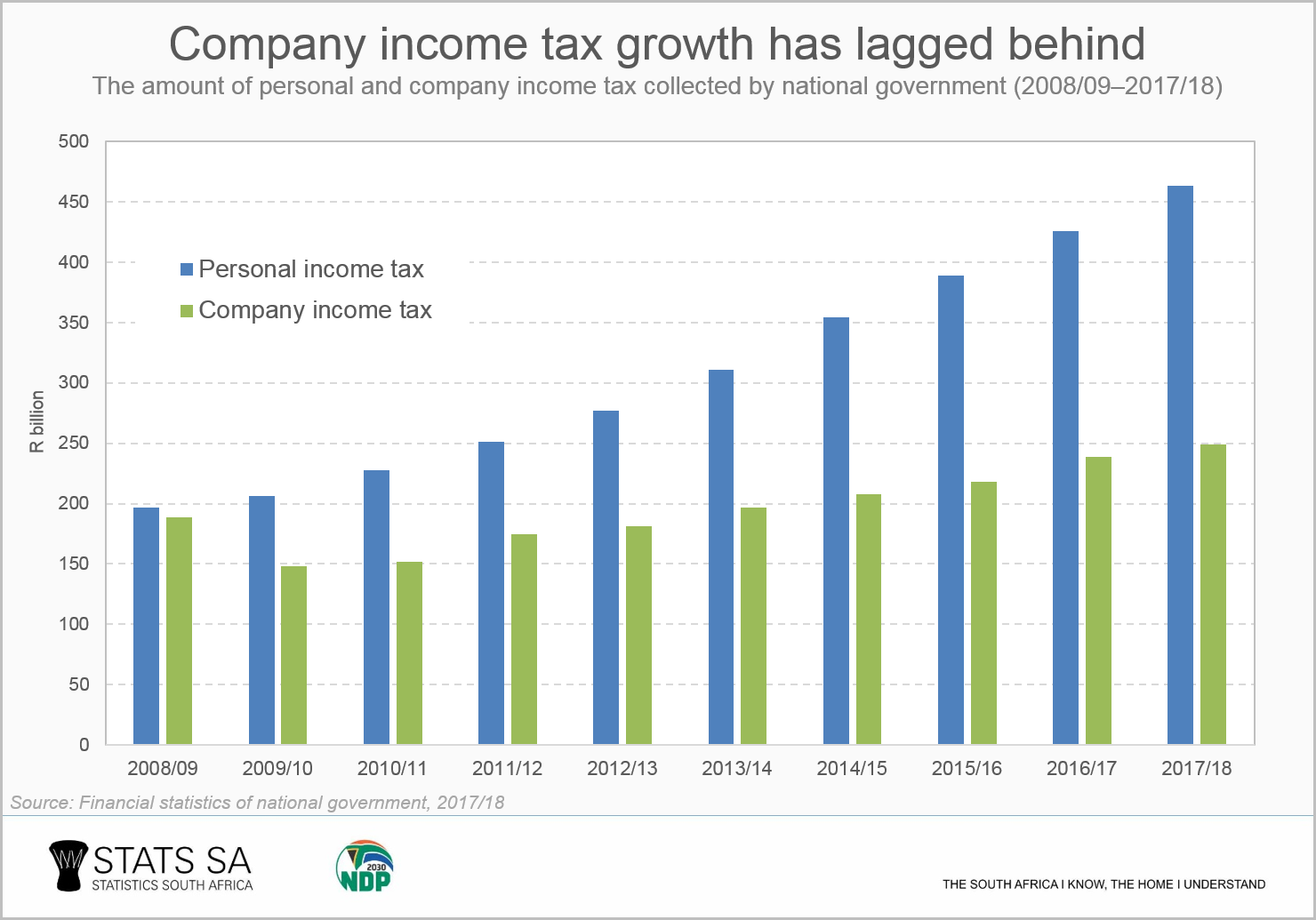

1 april 2025 and thereafter: The minister forecast an increase of 7.6% in tax revenue from r1,73 trillion (for the fiscal year ending 31 march 2025) to r1, 863 trillion (for the fiscal year ending 31 march 2025).

Treasury has also increased the threshold for retirement lump sum benefits and lump sum withdrawals tax tables as well as transfer duty tables by 10%.

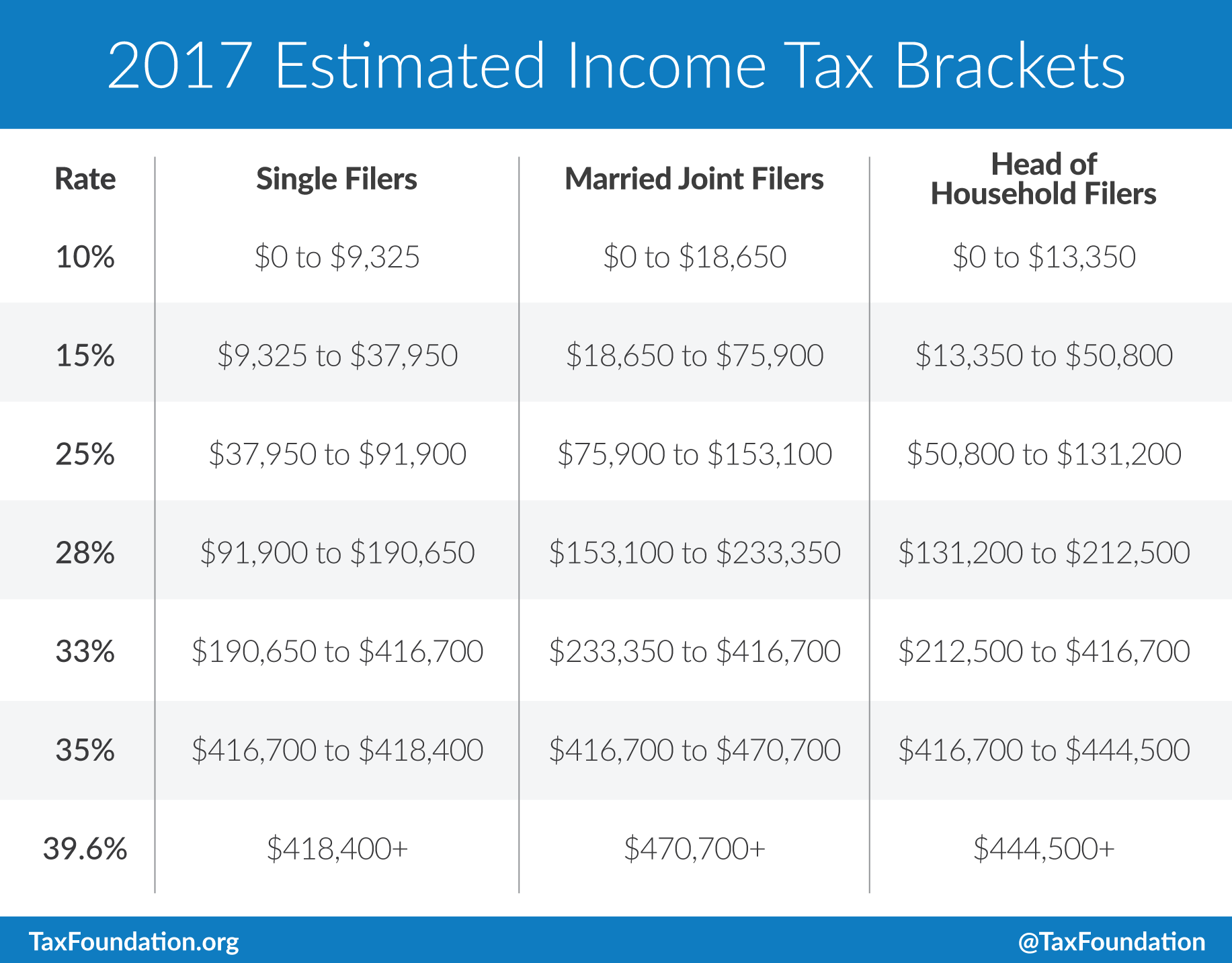

Federal Tax Earnings Brackets For 2025 And 2025 bestfinanceeye, 42 678 + 26% of taxable income. And that’s with a large number of small businesses.

Sars Tax Tables 2017 18, You would then need to make the relevant tax adjustments in order to arrive at the corporate taxable income for the year. Type rate of tax (r) companies 28% of taxable income.

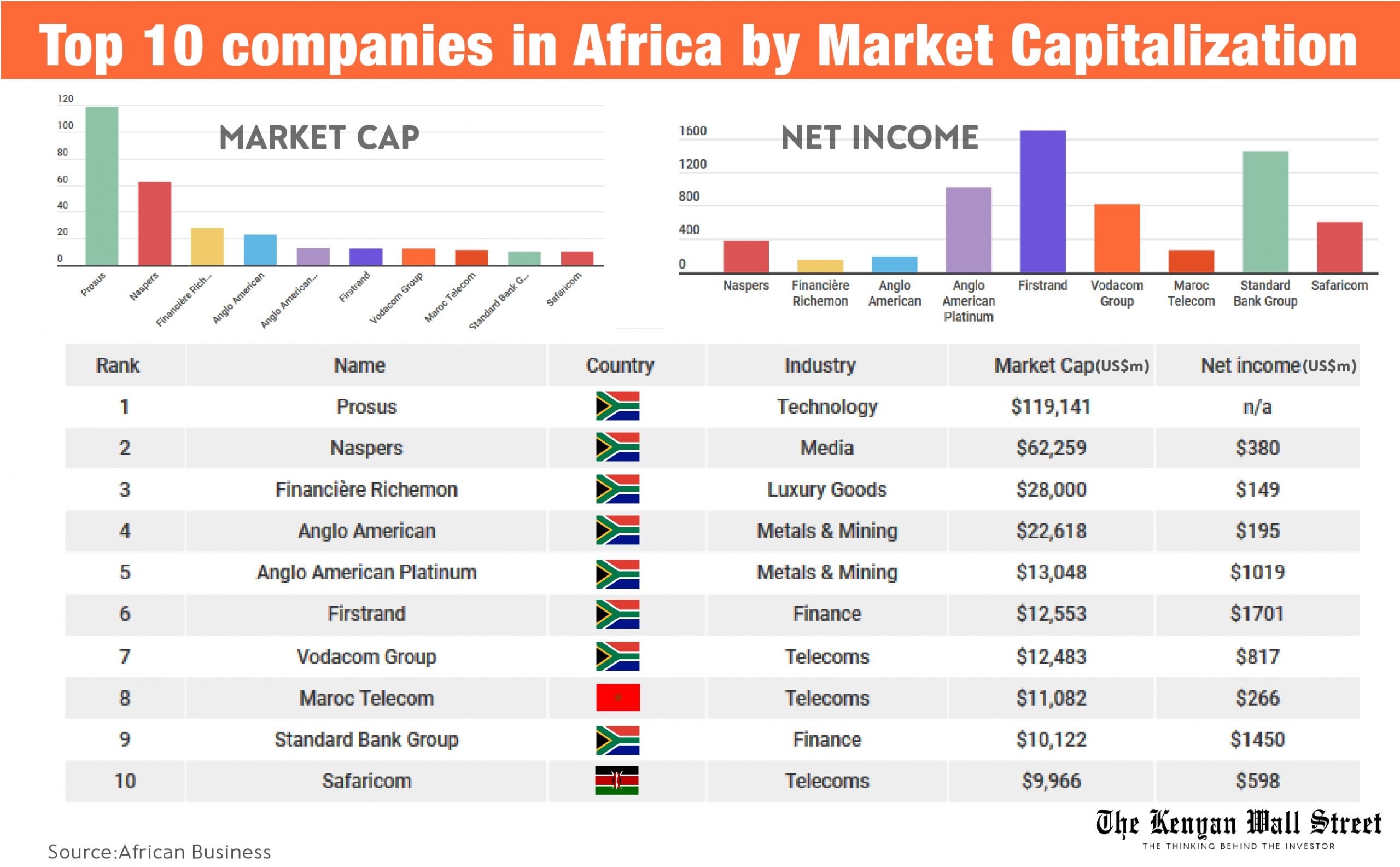

Lists Of The Biggest Companies And Businesses In Africa Largest Retail, Another boon for corporate taxpayers carried over from. How south africa’s tax system works for.

Tax Brackets in South Africa A Tax Payer Guide, Tax on goods and services in south africa. With tax brackets not being adjusted for inflation, south africans who received a salary increase this year will end up paying more tax or even being pushed.

State Individual Tax Rates And Brackets 2017 Tax Foundation, In this article, we’ll cover everything you need to know about the tax brackets in south africa. South african individuals are obligated to contribute a portion of their income as tax to the government, with.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, In this article, we delve into the intricacies of the south african revenue service (sars) tax rates for the year 2025. All share (j203) = 71 868 rand / dollar = 18.90

Here Are the Federal Tax Brackets for 2025 and 2025 FinaPress, A tax calculator for the 2025 tax year including salary, bonus, travel allowance, pension and annuity for different periods and age groups. 2025 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa.

B.C. Tax Brackets and Tax Rates in 2025, View the most up to date tax tables of sars ( south african revenue service ) see your tax rate here including a free tax calculator. The minister forecast an increase of 7.6% in tax revenue from r1,73 trillion (for the fiscal year ending 31 march 2025) to r1, 863 trillion (for the fiscal year ending 31 march 2025).

What Is The Top 1 Percent Of UK? (It's Lower Than You Think, In this article, we’ll cover everything you need to know about the tax brackets in south africa. South african individuals are obligated to contribute a portion of their income as tax to the government, with.

2017 Tax Brackets & March Madness H&R Block, Tax on goods and services in south africa. View the most up to date tax tables of sars ( south african revenue service ) see your tax rate here including a free tax calculator.

View the most up to date tax tables of sars ( south african revenue service ) see your tax rate here including a free tax calculator.